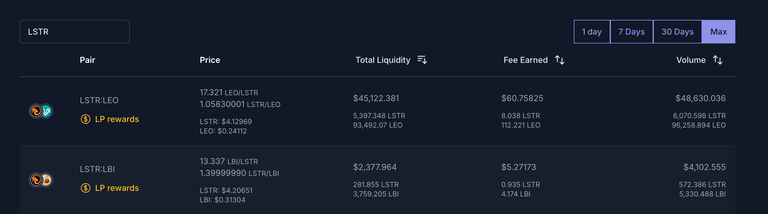

Question, what if LSTR owns 10 million and POL owns 2 million and 5 million is reduced from supply already and remaining are held by users in their wallet . How will LSTR get more LEO?

Liquidity Position. You deposit Hive and Leo into the pool then you own a Liquidity Position(LP) of your percentage of the pool. Any fees earned from trading activity are just added to your LP. You can withdraw at any time.

Just be careful because if you want to hold say 1000 LEO long term the pool may not be the best place. If LEO price rises faster than HIVE you will own less LEO and more HIVE.

The Chaotic Summer of Trade Wars: A Deep Dive into America's Economic Fallout

Introduction: Freedom Day Turns into a Summer of Disruption

Bevrijdingsdag, which was meant to symbolize America's economic independence, instead marked the beginning of a tumultuous summer characterized by skyrocketing prices and bureaucratic chaos. What was supposed to be a celebration turned into a period where American manufacturers drowned in the red tape created by their own government, and global supply chains began reconfiguring to avoid American ports. As shoes became 40% more expensive, the summer's turbulence laid bare the shortcomings of aggressive trade policies and their far-reaching consequences.

The Origins of the Trade War: Trump’s Tariffs and the Rationale Behind Them

The saga ignited on April 2nd, when President Trump announced sweeping tariffs aimed at revitalizing US manufacturing through protectionist measures. The idea was straightforward: by making imported goods more expensive, domestic producers could regain competitiveness. This bold move marked the most aggressive trade action in nearly a century, with tariffs ranging from 11% up to 50% targeting dozens of countries.

The tariffs were not only symbolic but aimed at strategic and geopolitical adversaries like Syria, Myanmar, and Switzerland, with rates nearing 40%. The administration set a 90-day negotiation window, which resembled a hostage situation rather than diplomacy, as countries scrambled to strike deals or face economic isolation. The culmination was the presidential decree of July 31, which formalized the tariffs and triggered immediate market chaos.

The Market Reactions: Shockwaves and Immediate Economic Impact

The initial announcement on April 2 doubled as a shockwave across global markets. The US tariffs, averaging 27%, contrasted sharply with the previous 2.5% average in 2024, signifying a seismic shift in American trade policy. During the 90-day period, nations like Vietnam managed to secure exemptions, but many others faced crippling tariffs that distorted global trade.

Financial markets grappled with the fallout: the stock market plummeted, with the S&P 500 dropping 1.6% and the Nasdaq 2.2%, marking one of the worst days in months. Unexpectedly, the US dollar surged despite the trade tensions, illustrating its status as a safe haven. Meanwhile, bond yields fell sharply, and raw material prices surged as traders hurried to assess which supply chains would survive these tariffs.

The Reality for American Businesses: Costs and Consequences

The real-world implications hit home immediately. Major automakers like Ford and General Motors saw their input costs skyrocket overnight. Apple projected a quarter impact of $1.1 billion due to tariffs. The National Association of Manufacturers reported that 89% of its members experienced higher costs, largely driven by government-imposed tariffs rather than foreign competition.

Small and medium-sized manufacturers bore the brunt, as they couldn't absorb the exponential increase in costs, especially for vital raw materials like steel. Instead of creating jobs domestically, many companies shifted production abroad to dodge tariffs, further weakening America's industrial base. The agricultural sector faced its own crisis, with China replacing US soybeans with Brazilian ones, and Europe rushing to establish new trade agreements with South American nations. Domestic farmers experienced declining exports and rising costs for essentials like fertilizer and machinery, with congressional aid efforts stalling politically.

The Poignant Irony: Offshoring and the Illusion of Patriotism

Many Wall Street critics argue that the tariffs are a delayed reckoning for decades of offshoring American jobs. Companies that previously outsourced manufacturing to China now find themselves paying the price as tariffs exacerbate their expenses. The irony is stark: firms that contributed to deindustrialization are now pleading for relief, while the workers—the "frontline" of production—face layoffs and factory closures.

The tariffs, rather than reinvigorate domestic industry, accelerate its decline by making remaining factories less competitive. What was marketed as a patriotic effort to fortify America's industry turns out to be a painful, chemotherapy-like process that hastens the eventual collapse of what little manufacturing remains.

The Fiscal Gains for the US Treasury and the Myth of Protectiveness

While industries suffer, the US government reaps record tariff revenues—over $87 billion in the first half of 2025 alone, surpassing total collections for all of 2024. President Trump lauded these figures as proof that tariffs made America "great and rich," but most of these gains come from American consumers bearing the tax burden, not from increased trade fairness.

Analysis reveals that only a tiny fraction (0.7%) of the tariffs’ costs are passed from Chinese exporters to US importers, with the lion's share—more than 99%—being paid by American consumers and businesses. The added costs of shoes, clothing, and electronics are now embedded in household budgets, adding an extra $2,400 annually for the average family.

The Inflation or Recession Dilemma: Economic Indicators and Future Risks

Despite the consumer price index remaining within the Federal Reserve's comfort zone at 2.7%, underlying indicators hint at trouble ahead. Import and producer prices are rising, and companies warn of upcoming inflation. Meanwhile, the housing market becomes increasingly unaffordable as tariffs increase costs for materials like Canadian lumber, further pushing up home prices and straining first-time buyers.

Consumer behavior is shifting—more people shop at dollar stores, and large retailers report demand for cheaper alternatives. The anticipated "K-shaped" recovery, where the wealthy thrive while the rest falter, appears inevitable. The Federal Reserve finds itself in a trap: raising interest rates to curb inflation risks pushing the economy into recession, while maintaining rates to support growth fuels inflation caused largely by the tariffs themselves.

Tech, Supply Chains, and the Global Shift

Technology companies like Apple and Microsoft warn of margin compression due to tariffs on components, impacting innovation and consumer electronics. Universities and research labs are also reconsidering international partnerships, wary of the geopolitical climate.

In response, China is deploying strategic resilience—doubling down on its "dual circulation" policy, boosting domestic consumption, and cultivating alternative markets in Southeast Asia and Africa. Meanwhile, tech firms are relocating production from China to Vietnam, Mexico, and Malaysia to dodge tariffs, maintaining access to the lucrative US market while undermining Washington's efforts at economic decoupling.

Geopolitical Ramifications: India and the Shifting Global Balance

India, once a partner of the US-led global supply chain, is now caught in a geopolitical bind. Trump’s tariffs and rhetoric labeled India a "dead economy," denying it exemptions on critical pharmaceuticals and electronics, effectively isolating its economy. This move is part of a broader strategy: China’s influence grows as the US pushes allies away, leading India to diversify its economic partnerships, including strengthening ties with Russia and pivoting towards regional blocks like ASEAN.

This fragmentation risks creating a semi-split world, with regional trade blocs forming in response to US policies—an evolution that could have lasting implications on global stability and economic integration.

The Legal Battles: Executive Powers and Constitutional Challenges

Trump’s tariff regime is built upon the International Emergency Economic Powers Act (IEEPA), which claims broad presidential authority during national emergencies. However, legal challenges have arisen, pointing out that the law does not explicitly authorize tariffs and that presidents have historically stretched its limits. A case pending before the Supreme Court questions whether presidents can unilaterally rewrite trade policies under the guise of emergency powers, highlighting the constitutional tension at play.

The Road Ahead: Risks, Profits, and a Divided Economy

As the tariffs begin to show their full effect in August, economic indicators point toward shrinking manufacturing activity, declining consumer confidence, and hesitancy among CEOs to invest. The political landscape is also shifting, with Republicans cautious to distance themselves from tariffs ahead of the 2026 midterms, and Democrats struggling to oppose a policy they see as both populist and harmful.

Meanwhile, logistical chaos unfolds at major ports like Los Angeles, where surges in imports strain infrastructure. The government plans to increase tariffs further—potentially raising base rates from 10% to 20% and imposing secondary tariffs of 40% on countries aiding others to evade tariffs—deepening the economic rift.

The summer of trade wars has laid bare the cracks in America's economic fortress. While the treasury reaps record revenues, the real economy suffers—factories close, farmers lose markets, and households bear soaring costs. The global order shifts as countries seek alternatives to US-controlled payment systems and trade networks splinter into regional blocs.

The question remains: will further tariffs "solve" the underlying issues, or will they accelerate the decline of American industrial dominance? History suggests that protective barriers often hasten deindustrialization rather than reverse it, and this summer's chaos might be just the beginning of a long-term recalibration of global economic power.

1/🧵 how do you want to be remembered for? What legacy do you want to live for your generation to come? Is it something the will be proud of or disappointed?

2/🧵The world is not our home; one day we will leave this earth. We will be remembered by the good legacy. Most times I ask myself, 'What will I be remembered for? If tomorrow I am not breathing again, what is that thing people will talk about? Will it be good or bad?' There are some opportunities I am enjoying today; this is as a result of the good legacy my father left behind. When I am no more, I want to be remembered for the good things I do for the people around me. I want to be remembered as a heroine of my community, someone that my community will always sing of my praise even when I am no more. My generation to come will benefit because of the good legacy I left behind.

3/🧵how do you want to be remembered for? What legacy do you want to live for your generation to come? Is it something the will be proud of or disappointed? I will be delighted to read your thoughts on this post below is link to my post.

💵 Although many expected a shift to a cashless society, cash continues to be significant for Europeans, even among the youth. According to an ECB report, cash is still important for wealth preservation, particularly after the COVID era.

Y tal milagro ocurrió ayer en el T-Mobile Park de Seattle, WA, donde los locales Marineros homenajearon al recién exaltado HOF de la MLB Ichiro Suzuki..!

Mientras, en San Diego, Luis Arráez fue el JMV del juego ganado los Padres, sobre los Medias Rojas, llevándose la serie y acercando a Padres 2 juegos de los Dodgers..!

Greetings , Greetings... I can't believe I'm back here and back for good inother to unleash all I've got in stock. My phone has been faulty all this while that I've been absent from the platform. Happy to be back again. 😀 😍 ✌️

Don't hesitate in asking, if you have any question about INLEO (this social network), LeoDex (our decentralized exchange), or any other component of the LEO ecosystem 😊.

hmm depends there is still some buying power to do so, but moving the pool and get the arbitrage bots to build support there is getting more expensive.

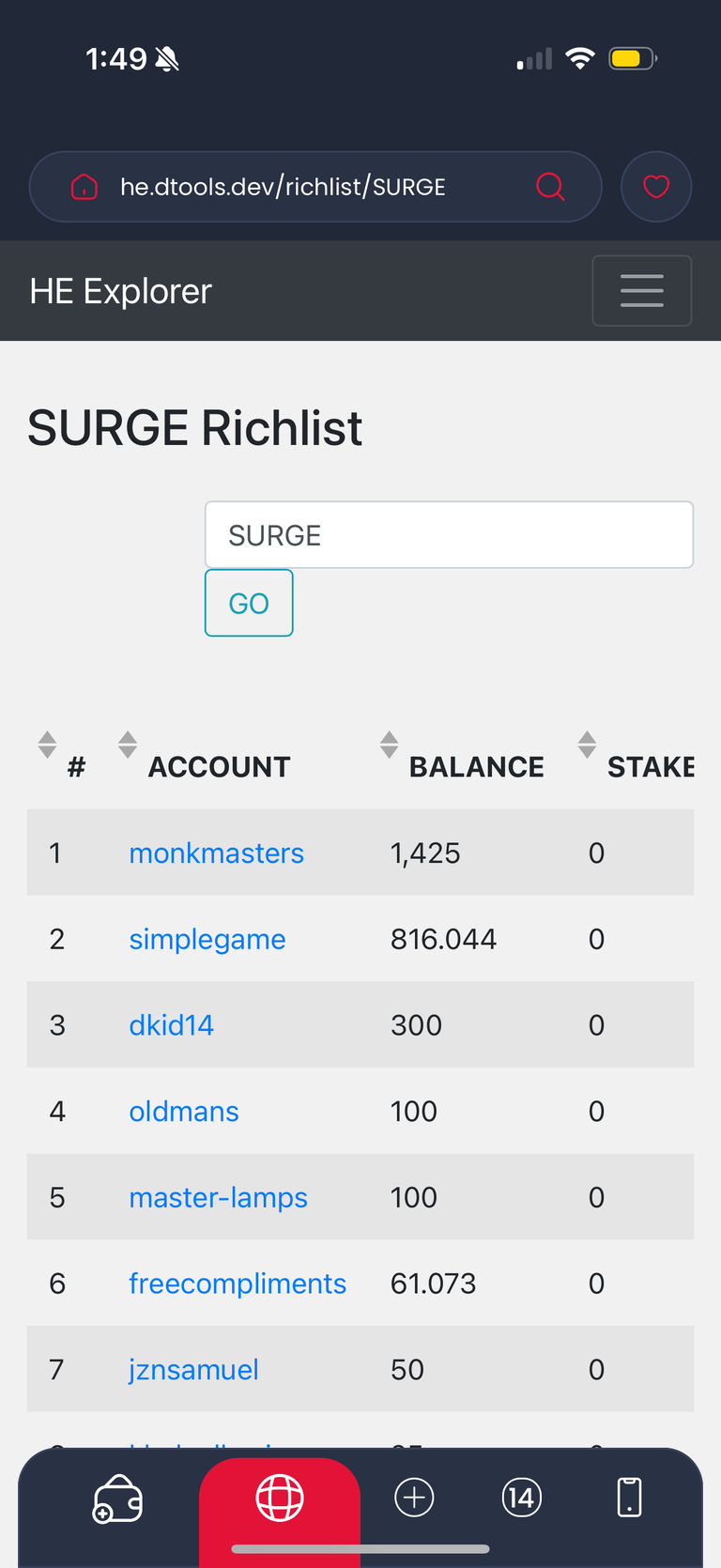

So it depends on the pace the team decides to set, if the h-e richlist shows big unstaking coming up waiting here might be smart to save some capital. That being said, I see nothing but momentum for the next few weeks so yeah We will get to $1

A genuine woman values the quality of attention over its quantity. Thus, the gaze from the one right man is the only one that truly matters to her. His gaze is the only one that fully validates and affirms her.

Do not underestimate the perseverance of #leo team. There was a vision and despite all the troubles coming from all sides, we have 0% #crypto loans ready.

These are safe and sustainable loans. Protocol will generate revenue instead of keeping the assets idle. There is no need to charge interest to users.

LEO is becoming more like Sky (Maker DAO). Adjust valuations accordingly.

1/ 🧵

The LEO token has impressed us with its performance this month. However, it didn't happen by chance; there's a backstory we need to consider, one that involves a great deal of work and staged ideas that made this remarkable price surge possible.

2/🧵

An economy is strengthening that involves ideas perfectly designed for sustainable, yet exponential, growth. More users are seeing this opportunity, as are investors who see a product being given consistency and dedication; something that LEO demonstrates daily.

3/🧵

It's truly incredible the new developments that arrive every day, the proposals to improve what is already amazing, and most of all, seeing how what's being created works under a well-thought-out logic.

I invite you to read my new article, which briefly reviews the impact LEO is having.

Commemorating Two Years of The Great War: A Detailed Weekly Breakdown

As the weeks pass, each episode of The Great War kicks off with a captivating hook—whether it's the first use of poison gas, Italy joining the battlefield, or another intense event. This week’s opening is particularly striking: "This war has now been raging for exactly two years." Host Indy Neidell sets the tone for a comprehensive review of the ongoing conflict, highlighting major battles and strategic developments from the past week.

Last week saw Australian forces launch a diversionary attack at Fréméry, aiming to halt the German advance towards the Somme. However, the operation turned into a disaster because many German units had no intention of heading south. The British managed a night assault at the Somme but lacked subsequent support to capitalize on their gains.

On the Eastern Front, Russian forces made steady progress, continuing their assault against Austria-Hungary’s lines. The situation remained dire for the Central Powers in that region.

The planned French and British assault on July 23 turned into a chaotic series of uncoordinated attacks. The French commander Maurice Balfourier announced he wouldn't be ready until July 24, prompting British General Sir Henry Rawlinson to proceed without full French support. Starting with a preliminary artillery bombardment on July 22 at 7 pm and the main attack at 1:30 am on July 23, the offensive soon faced logistical issues.

Further complicating matters, French forces under Cambrai’s 13th Army and Fayolle’s units planned their attack at 3:40 am without clear explanations. These fragmented timing decisions—which included a surprise second assault mimicking the main attack hours earlier—led to overlapping attacks, exposing the element of surprise and causing chaos among the Allied forces.

Poor weather conditions for days prior prevented effective artillery observation, crucial since many German trenches were positioned on reverse slopes and difficult to target directly. Consequently, the early assaults became major but futile attempts that resulted in frustration and staggering losses. It was a stark example of how logistical misjudgments and lack of coordination could turn promising assaults into disastrous failures.

Amidst the chaos, the British artillery near Gieaumont was effective, devastating German trench defenses with well-aimed bombardments. Unfortunately, German soldiers adapted quickly, employing new tactics: they moved machine guns outside trenches into rifle pits, making them harder to locate and destroy.

British artillery responded with larger-than-ever bombardments, using massive quantities of shells—over 36,800 cannons firing approximately 125,000,000 pounds of explosives—to soften enemy positions. When the infantry advanced, they made significant progress, capturing Longueval and Delville Forest, and pushing further into enemy territory despite high casualties from machine gun fire from the flanks.

The Eastern Front: Russian Advances and Austrian Retreats

On the Eastern Front, Russian forces under Aleksandr Brusilov launched a massive offensive that saw considerable success. By July 28, they had taken Brody, capturing 40,000 prisoners over 12 days. The entire Austrian Second Army retreated, exposing significant weaknesses in the Austro-Hungarian military structure.

Leadership Challenges and German Involvement

This collapse prompted sharp criticism of Austrian command, especially Chief of Staff Conrad von Hötzendorf, who was facing the threat of losing his position. The high command concluded that the primary problem lay in leadership, not troop strength. Recommendations included integrating German and Austro-Hungarian forces for better coordination.

German Field Marshal Paul von Hindenburg and General Erich Ludendorff took charge of a large part of the Eastern Front, especially along Pripet. They aimed to seize full control of the eastern theater, but this involved political complexities, including reduced influence for Austrian commanders like Karl von Franza-Baldin who now had German advisors.

Strategic Struggles and Political Intrigue

German military leadership, notably Erich von Falkenhayn, sought to dominate the eastern front. However, their control was challenged by the ongoing stalemate at Verdun, the shifting fortunes at the Somme, and the potential entry of Romania into the Allies. These developments diminished Germany's strategic confidence and placed pressure on leadership decisions.

Meanwhile, the fragile coordination within the Austro-Hungarian army caused issues, with some commanders advocating for a merger with German forces, as the Germans consistently performed better on the battlefield.

The Battle of the Baranovichi: A Month-Long Clash Ends

After a prolonged month of fighting, the Battle of Baranovichi concluded, finally bringing relief to Russian forces. Despite their numerical disadvantage—Russia’s army was approximately 40% the size of the German forces—Russian troops inflicted relatively minor casualties on the Germans (around 16,000 compared to Russian losses of 80,000).

While the defeat was a blow to Russian morale, they achieved significant success in Asia Minor, capturing Erzincan from Ottoman forces. This duality highlighted the ongoing ebb and flow of the war, with victories and setbacks occurring simultaneously across different fronts.

Other Significant Events

Arab Revolt Gains Momentum: On July 27, the port of Jaffa in Palestine was captured by Arab insurgents, marking a key strategic victory in the Arab revolt against Ottoman rule.

The Trial and Execution of Charles Fayet: The captain of the Belgian ship Brussels, Charles Fayet, faced military court for attempting to ram a German U-boat. Found guilty of piracy, he was executed by German forces—a tragic testament to wartime justice.

Resetting the Balance in the Balkans: Serbian forces, having endured a brutal winter march through Albania, reassembled in Salonika and prepared for future engagements against the Central Powers, demonstrating resilience despite setbacks.

Reflection: Two Years of Global Conflict

As the two-year mark of this devastating world war approaches, the scale of destruction becomes staggering. The combined casualties from the battles of Verdun, Somme, and Brusilov could total up to four million lives lost—a somber reminder of the war’s toll.

Despite all the chaos, some regions—such as the Middle East and Anatolia—experienced surprising success for the Allies, adding complexity to the war's overall trajectory.

This week also marks the two-year anniversary of our series. We extend our heartfelt thanks to supporters and viewers who have followed us through these tumultuous years. For those interested in revisiting the war's major moments, check out our recap playlists. Special thanks to Patreon supporter Tom Trautmann—the first patron of our channel—whose support sustains this project.

Make sure to subscribe to stay updated, and we look forward to sharing more detailed analyses next week.

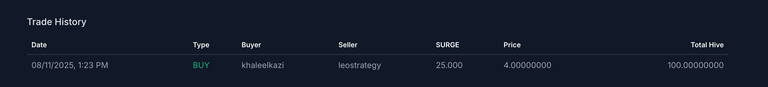

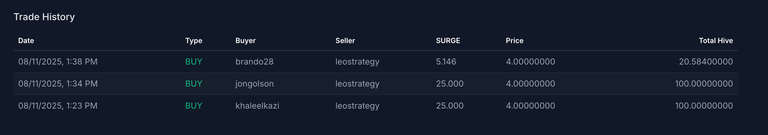

The key to the leverage on Leostrategy is not to lever things up, increasing the risk profile. Instead, the ultimate leverage will come from different streams flowing in which place more $LEO on the balance sheet.

Think of this as leverage due to multiple paths of asset accumulation versus simply riding the value of LEO higher.

Imagine putting HBD in savings. This is the same where you are getting 15%. But you also get the option based upon LSTR move higher. This exposure allows you to convert the SURGE to LSTR over $50.

A perpetual preferred token offering downside-protection and stable, 16.67% yields paid in stablecoin (HBD) or LSTR every single week

We're bringing this product to market at a time when Lions need it most. LEO, BTC, ETH and other cryptos are mooning and it may be worthwhile to diversify some of those profits into something that has:

A par value of $1 (initial sale is priced at $0.90)

A stable, reliable yield of 16.67% effective yield at initial sale prices

Upside value as SURGE is convertible to LSTR tokens at a $50 "strike" price

Effectively, SURGE protects your downside while paying you weekly yield and giving you future upside in the LEO Token's immense growth that is to come.

Read our full blog post (linked below) for details

The First World War has long been overshadowed by its successor, the Second World War, leading to numerous misconceptions about its origins, scope, and key players. In a detailed exploration, historian Indy Neidell challenges these myths and sheds light on lesser-known truths, helping to provide a more comprehensive understanding of this pivotal conflict.

Contrary to popular belief, Russia was far from a minor military force during World War I. While their reputation suffered after their 1917 revolution and subsequent retreat, during the war, Russian forces demonstrated considerable strength. They made significant advances in Eastern Anatolia and launched the Brusilov Offensive, a groundbreaking campaign that almost dismantled Austria-Hungary’s army and threatened the entire empire’s stability.

By 1916, Russia had also undergone a substantial modernization of its military industry, refuting the notion of an outdated or ineffectual Russian military. These achievements underscore Russia’s crucial, albeit complicated, role in the war.

Many assume that all there is to know about World War I has already been uncovered, but this is far from true. Scholars continue to unearth new information, like that Edith Cavell, historically portrayed as a nurse, was actually involved in espionage for Britain. Additionally, some of the war’s infamous narratives, such as Falkenhayn’s claim that Verdun was designed solely to bleed France dry, might be post-war justifications rather than facts.

Declassified documents released a century after the war promise to shed even more light on these events, indicating that our understanding of WWI remains incomplete and evolving.

The widespread perception of Germans as the villainous aggressors stems largely from World War II narratives and wartime propaganda of the First World War. Yet, the truth is more nuanced. Germany was not solely to blame for igniting the conflict. Many European nations shared outdated ideas about war’s necessity, and escalation involved collective decisions.

Atrocities committed, such as the Rape of Belgium, were committed by all sides. Furthermore, the Armenian Genocide and Russian massacres in East Prussia exemplify the brutalities perpetrated across the entire continent, challenging the simplistic villain-versus-hero narrative.

The romanticized image of World War I aerial combat features dashing aces like the Red Baron and Billy Bishop engaging in chivalrous dogfights. In reality, air warfare was brutal and deadly. Pilots flew in formations using machine guns and often with life expectancies measured in hours, not days.

Contrary to the noble image, the "perfect kill" was often about ambush and surprise rather than honor, a stark reminder of the war’s brutality in the skies.

The War Was Truly a Global Conflict

Although the war originated in Europe and much of the fighting took place there, it is erroneous to classify it solely as a European war. Once the Ottoman Empire entered the conflict, the war expanded into the Middle East and Asia.

Japan, fighting Germany, the United States, and Brazil, joined the fray, with battles occurring across the Pacific and Atlantic. Soldiers from every continent except Antarctica fought, with campaigns extending into Africa, Persia, Mesopotamia, Libya, and India’s borders. The global scale of the conflict makes it indisputably a world war.

Trench Warfare Was Not the Entire War

While trenches symbolize WWI, they did not dominate every front. The Western Front is famous for its extensive trench networks, but in deserts and open spaces, such as the Eastern Front, cavalry and mobile warfare remained vital. The sheer geographical diversity of the war meant that some areas saw little to no trench warfare, highlighting the multifaceted nature of the conflict.

Many believe military tactics remained static throughout the war’s duration. In reality, tactics changed dramatically between 1914 and 1918. The stalemate prompted innovative solutions, including the development of mechanized warfare, tanks, and improved artillery techniques.

These tactical innovations laid the groundwork for the mechanized warfare seen in WWII, demonstrating that the war was a period of significant military evolution rather than stagnation.

The dominance of land battles can overshadow the importance of naval warfare in WWI. The Battle of Jutland, the largest naval engagement in history, took place during this conflict. Britain’s blockade of Germany was a key strategy, choking off supplies and contributing significantly to Germany’s eventual defeat.

German U-boats conducted unrestricted submarine warfare, disrupting Allied shipping and escalating tensions. Naval power was central to controlling seas and impacting the broader war effort.

The German Army Was Not Defeated on the Battlefield

Despite enduring some of the most intense fighting and staging a series of last-ditch offensives in 1918, Germany’s army was effectively defeated. By then, their forces suffered from severe shortages, low morale, and collapsing allies.

Germany’s decision to seek an armistice before breaching the Hindenburg Line underscores that attrition and internal breakdown, rather than decisive battlefield defeat, led to their surrender.

The War Was Not Confined to the Western Front

The Western Front is often portrayed as the sole theater of WWI, but the conflict was truly global. Fronts stretched across the Eastern Front, the Balkans, the Middle East, Africa, and even Asia.

Campaigns in Gallipoli, the Caucasus, the Middle East, and across colonial territories show how widespread the war’s impact was. This extensive geographic scope refutes the idea that WWI was a purely European affair.

Conclusion

The First World War was a complex, multifaceted conflict, far removed from simplistic narratives and popular myths. From the capabilities of the Russian military to the global scale of the war, and from tactical innovations to the nuanced roles of nations and soldiers, understanding the true history enhances our appreciation of this cataclysmic event.

As ongoing research continues to uncover new insights, it remains crucial to challenge stereotypes and embrace a comprehensive view of World War I—its causes, conduct, and consequences.

If you’re eager to learn more, explore over 200 videos on WWI and start with the introductory "WWI 101" series. Stay curious and keep questioning history.

#moviesonleo #cinema #review Spock's inevitable resurrection after his heroic death in Wrath of Khan is handled surprisingly well in the third film of Star Trek film series. (link in reply)

"Questions? We're expecting a lot as the financials of this can be complex. Please give the post above/use AI to summarize and explain it to you and then leave a comment below and someone from the LeoStrategy board will reply to you." GOLD

The human heart teaches honesty, empathy, and patience—key traits in crypto too. Smart investing isn’t just numbers; it needs integrity, emotional control, and smart risk management. Balance both for success in life and crypto. #Crypto

2/🧵 That’s not necessarily what the exhibition’s name refers to, though. An exhibition that puts the stamp of conformity on what was once radical. Can an artist remain radical anyway?

3/🧵 Without being suicidal—starving to death, poisoning themselves, or causing themselves serious harm? Isn’t it either success—followed by wearing a Greek-theatre mask of a radical—or a failure, which means getting stuck neck-deep in the soul-draining gig economy, or settling for a boring, dull 9-to-5 job?

4/🧵 Let me take you to one of the most prestigious galleries in the Czech Republic, to meet Iván Argote, a Paris-based Colombian artist. Lucky one—of the successful kin.

If you're feeling wealthy on the latest LEO rise, SURGE offers a way to cap your downside and earn some income while still having long-dated exposure to LEO's upside

This is a masterstroke in economics. Mirrored after Micrsotrategy's STRK

The timing of this is impeccable as people look to hedge profits out of LEO on the way up. It also has the added effect of people selling LEO while LSTR is buying LEO

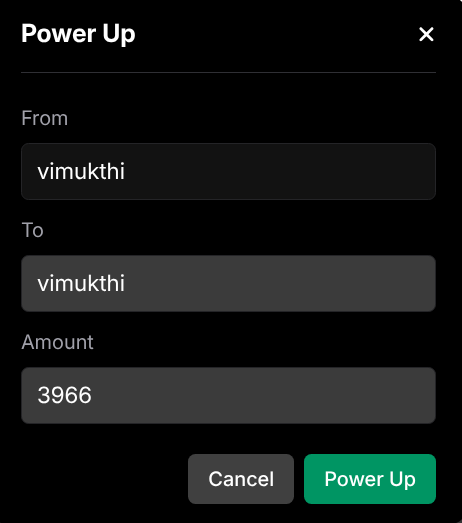

Joining the @lstr.voter delegation gang. I will power up another 5000 $LEO on this account when the first week of powerdown completes on my alt account.

Please don't hurt me now that I temporarily lost my cub status. 😁

SURGE caps your downside since the par value is $1. It does this while giving you unlimited potential upside since you have a $50 call option on the LSTR future price

While you wait for LSTR to cross $50 and higher, you earn 16.67% yield

Thank you to the few of you who are already SURGING in. There are only 500,000 SURGE available in this initial sale (similar to LSTR's initial sale of 100,000 LSTR tokens)

Haha take some time to understand it is what I'd say

It's basically like buying HBD but imagine if HBD had a call option attached to it

So you earn yield with the idea that one day, if HIVE was worth exponentially more, that HBD can be converted to HIVE at the higher price

Does that make sense?

SURGE pays you yield while you wait for LSTR to be worth more than $50. After that, you can convert 50 SURGE to 1 LSTR. So if LSTR hits $60, you effectively make $10+ in upside along with all the accrued yield

Bolivia and El Salvador have signed a digital assets agreement

Bolivia’s latest step toward digital asset adoption came with a Memorandum of Understanding between its Central Bank (BCB) and El Salvador’s National Commission for Digital Assets (#CNAD).

El Salvador continues to lead Latin America’s Bitcoin adoption push, while #Bolivia lifted its decade-long #ban on cryptos in mid-2024. The South American country has seen digital asset transactions #surge over 500% in just six months, reaching $294M by April.

The deal includes shared research, cross-border tech infrastructure discussions, risk analysis, #regulatory collaboration & supervising virtual asset service providers (#VASPs).

Bolivia’s goal is to regulate the sector while expanding its use for #remittances, business payments, and as a safeguard against a rapidly devaluing Boliviano (#BOB).

Delta: describes the relationship between changes in asset prices and changes in option prices. Delta is

also the hedge ratio (change in the price of an option for a 1 unit change in the price of the underlying

stock). Call option deltas are positive because as the underlying asset price increases, call option value also

increases. Conversely, the delta of a put option is negative because the put value falls as the asset price

increases.

I had too much idle $LEO doing nothing. From now on I will be curating with this extra Voting Power. Absolutely no plans of Powering Down until we get ready for sLEO with USDC earnings.

#leo combined with @leostrategy has the potential to be our Sky (MakerDAO). Keep that in mind when planing and comparing.

Happy Wallet, Easy Life" – keep your portfolio balanced, avoid risky all-ins, and make sure your gains aren’t just on paper so you and your loved ones can actually enjoy them

$SURGE! 😀 But seriously, check out the new tokenomics, LEO now deflationary + so many other smart decisions, LeoDEX volume rising, Leo Strategy, there's just too many to mention and even though Premium members have more space to write, I still think I would run out of capacity.

Interesting to se how long it takes to be sold at discount... and also raises a question, how long does it take to unstake my HBD and would there still be any left? 😅

Yeah, might still be there, I'm thinking people want more LEO & LSTR and probably don't want to sell into SURGE with those. Then again, I'm probably not the only one thinking about that HBD unstake option! 😅

Yeah, you're going to have plenty of time with this one. I'm thinking at least a couple weeks, probably longer. There's been a lot of scrounging around by people trying to get as much LSTR and LEO as possible. I would bet a lot of people are tapped out and this will last a while. Plus, there is really no rush on this one. Your price appreciation doesn't happen until LSTR is over $50. Right now you can buy LSTR for what, $4? It's probably still more attractive to just buy the LSTR at this point. I bought a little SURGE, more so I can easily keep track of it in my wallet, than for the yield at this point. I like the idea of getting enough to pay my Premium membership, but beyond that, I'd rather buy LEO.

Good points. At the moment, it doesn't make that much sense to move LSTR or LEO into SURGE, but unstaking HBD is something I'm thinking about. There's the 10% discount + better APR...

Yeah, that's a much better comparison. If you're in HBD, then replacing it with SURGE could be a no-brainer. You get an immediate 10% return because you're buying it at a discount, you get the same 15% yield (which is actually 16.67% on SURGE because you're getting it at .90 instead of $1), and you also have the potential to make capital gains on LSTR if it shoots up over $50. 3 big plusses compared to HBD.

Gamma: measures the rate of change in delta as the underlying stock price changes. Gamma captures the curvature of the option value vs. stock price relationship. Option gamma is defined as the change in a given option delta for a given small change in the stock's value, holding everything else constant. Thus, the gamma of a long or short position in one share of stock is 0, because the delta of a share of stock never changes.

For example, a gamma of 0.04 implies that a $1 increase in the price of the underlying stock will cause a call option's delta to increase by 0.04, making the call option more sensitive to changes in the stock price.

sLEO - staked $LEO on Arbitrum that will earn USDC based upon LeoDex fees

$LSTR - a financial layer that accumulates $LEO, stakes it, and builds out additional products to keep adding $LEO to balance sheet.

@lstr.voter - delegate LP which Leostrategy takes a management fee. This provides more LEO to the balance sheet

$SURGE - a convertible instrument that pays a yield of 15% while also providing the option to convert SURGE to LSTR once about $50. The money raised from the sale of SURGE adds LEO to the Leostrategy balance sheet.

That is up to each individual. LSTR, in my view, is less susceptible to the price fluctuations than $LEO simply due to the fact that we are dealing with balance sheet value and revenue streams driving more LEO in on a daily basis.

What does LEO have other than simply more people buying than selling (or vice versa).

Ironically, from the LSTR perspective, a lower $LEO price is of benefit.

The 500,000 SURGE counts as part of the 900,000 LSTR that are in the inventory since SURGE will be convertible to LSTR? Essentially taking a total of 600,000 LSTR off the market once sold out?

I've grown up in New Delhi since my childhood and I fell in love right from the start itself which did made me feel very fortunate enough to be a part of the city. However there are a few gaps as well which exist in Delhi.

Delhi has many amazing things but a few improvements like the pollution issue, maintaining public infra etc can surely do wonders for the city. Authorities are trying to address many of the issues but the progress is slow.

Life on Inleo is like crypto charts — sometimes you post and moon, sometimes you post and flatline… but you keep posting because the next block might be the big one.

This is very important for people to understand about SURGE.

Payment Frequency and Method: Weekly (every Monday); payable in HBD (Stablecoin on Hive) or LSTR shares which are repurchased from the market at the time of distribution and payable at 95% of the current LSTR price at the time of distribution (the remaining 5% buffer is to be captured as revenue by LeoStrategy and deployed to purchase LEO for our balance sheet)

🇵🇱 By 2026, the Czech Republic plans to shut down its final hard coal mine, leaving Poland as the European Union's sole producer of this energy source.

Unrelated question: is it worth voting for the bots like Leo.Alerts if the Hive side is just going to downvote them to zero? I mean, ideally the bots would generate HP and HBD to feed the SIRP, but if they're zero it doesn't do much good, does it?

Vega: measures the sensitivity of the option price to changes in the volatility of returns on the underlying asset. The higher the volatility the higher the vega and is positive for both calls and puts. Vega gets larger when options are at or near the money.

People asked for the ability to earn yield within LEO and @leostrategy provided $SURGE.

Now Lions can have an asset which provides yield (15% like HBD) but can be converted to $LSTR. Thus we have a convertible note similar to what MSTR employs in some of its funding.

This will help to amass more $LEO on the balance sheet of Leostrategy.

You can own SURGE without LSTR. SURGE is a convertible note.

By owning it you get 15% return (just like HBD in savings). There is presently a 10% discount, with it being sold at 90 cents.

Once $LSTR hits $50, the conversion is 50 SURGE = 1 LSTR. If you hold as the LSTR price goes up, the conversion is the same 50 SURGE = 1 LSTR (or $1 each).

If LSTR goes to $100, you conversion doesnt change but you have a LSTR worth $100 (or $2 for each SURGE).

PLUS you get the 15% APR the entire time you hold SURGE.

I would have gone for 50 $SURGE but not having enough funds, so I think I can do 25 $SURGE and hold in one account or split it to be in my two accounts.

Theta: measures the sensitivity of option price to the passage of time. Option theta is the rate at which the option time value declines as the option approaches expiration. Like gamma, theta cannot be adjusted with stock trades. The gain or loss of an option portfolio in response to the mere passage of calendar time is known as time decay. Typically, theta is negative for options. That is, as calendar time passes, expiration time declines and the option value also declines. As time passes and a call option approaches maturity, its speculative value declines, all else equal.

A bitcoin whale has transferred 1,100 BTC, worth $125 million, after 8 years. 🐋💰 The funds are now distributed across 11 new wallets, still unspent for the moment.

Not true. You have a multi-millionaires stack of LEO. In 2 years, you will be ahead of 99% of people in the crypto world, and probably the world in general.

SURGE acting as a perpetual call option cannot be stressed enough. We all heard how CEOs make massive bank by having options as part of the compensation package.

Let us look at $SURGE.

50 SURGE = 1 $LSTR at the $50 price (or $1 each on conversion)

What if the price goes to $100?

50 SURGE = 1 LSTR now valued at $100 (or $2 each).

so swap Leo for surge. Still hold on to the upside but get 15% in return? Max increase of lstr tokens is 10k? Might consider doing this for some surge.

Life is hard to predict, as uncertainty is a part of life. Uncertainty can bring something good for us, and it can also bring bad for us also. Sometimes it helps us to meet some strangers in life also who can create a deep impression.

A deep impression from strangers is not an easy thing. Only a few people can make it possible. Have you ever met a stranger who created a deep impression on you? Who was that?

1/🧵I made a few important moves on #leo today. I have a reached a stake of 20,000 LEO with 25% of it delegated to @lstr.voter. The goal is to get more #lstr through a DCA strategy.

$BTC could realistically 1.5X - 2X from the current prices based on historical results of the following indicator. Imagine where we could end up if we keep up developing.

2/🧵Our goal should be to become a mainstream name. We are approaching this within Dash community and THORChain + @mayaprotocol. We need to expand what we are doing and generate revenue.

Most projects in cryptosphere are not generating much revenue. We need to market this fact and show the world that our 6 years of building is among the best products in Web 3.

3/🧵With the ability to get a 0% interest loan for sLEO, it may not even require investors to sell their $LEO to take profits or pay for their expenses. Minimizing selling pressure is an important part of the new Tokenomics.

Years have been dedicated to assisting founders in growing audiences that expand their businesses. Interestingly, they often possessed the talent from the start but didn't know how to showcase it.

Because a 30% vote gives out 6 times as much as a 5% vote does.

Anyway, if you think LSTR is for curation, you better skip this idea and just power up LEO.

If you move it to SURGE you get it for .90 on the dollar. Immediate 10% return.

SURGE will pay you the same 15% but it actually works out to 16.67% because you got it for .90 instead of $1.00.

You now have the potential to also earn capital gains if LSTR goes over $50.

So, you can stay in HBD and get 15% (assuming they don't knock it down to 12% again). Or, you can make an instant 10%, get a slightly better yield, and be in a position to benefit from a massive rise in LSTR.

Yes, 50 SURGE can be traded for 1 LSTR. So basically, you'll make yield all the way up, and then if and when LSTR goes over 50, you can convert your SURGE to LSTR. I will probably wait until LSTR goes to $70 or more, unless there is something else I can do with my LSTR other than sell. Once you convert, you no longer get the yield, so if you're not going to sell the LSTR right away, might as well hold onto the SURGE and collect the yield until you're ready to sell. Just my thoughts.

Correct. It's actually 15%, same as HBD, but because you are buying the SURGE at a 10% discount, the yield works out to 16.67%. For example, 100 HBD costs $100 and pays you $15 over the year. 100 SURGE costs you $90 and pays you the same $15 over the year. So you still get the same payment, but because you spent less for the SURGE, the yield is higher. Looking at it another way, $100 into SURGE actually buys you 111 SURGE tokens. You get 15% on those 111.11 tokens, which $16.67. So, the yield on SURGE is actually 16.67%. Make sense?

Purpose is when you deeply understand the single most important thing to you, the one that makes life lose its vibrancy without it, and you center your life around this core part of your being. Purpose is, therefore, a form of devotion.

It's funny, I remember talking to my wife about 6 months ago. And telling her, I was going to start powering down to get more LEO. Everything was coming together and I thought it was crazy how cheap it was.

🎉 Fei Scho in Munich has been accepting BTC via Lightning since late 2021! 🥢

A massive congratulations to Fei Scho for supporting $BTC adoption in Germany.

Watching $LEO and the team behind the project go against all odds, to merging as a shinning start has been a joy to see.. Something to be proud of right there

I think $SURGE and lstr.voter deserve an AMA with everything going on, after reading a couple of times the $SURGE blog post decided to turn 1000 $LEO into $SURGE, for a few reasons

Leostrategy gets more liquidity to keep accumulating more $LEO, most likely price of $LEO goes up

I get more exposure to $LSTR

I also have the option to get rewards on $HBD (Still dont know how to set this up)

16.67% yield as I understand is fixed, not like $HBD that can be change

Its only 1k $LEO from my 15k is only 7% of my total bag

Im commited to hold all my crypto for the next 5 years, bag is too young to chash out

Some of the reasons but Im sure yet I dont fully understand the product, might be other benefits to it....when AMA

#skiptvads, #surge

Yes that is a good way of doing it. That would get you the per unit value of LSTR and you can compare to the price to find the premium or discount.

Or you could do the market cap of LSTR by the total amount of LEO held by Leostrategy which would require the arb address of the sLEO that it moved over.

There is only ~29,990,000 $LEO left (and this reduces daily from Bridge & SIRP burns)

LeoStrategy wants to buy 10M LEO

POL wants to buy 2M LEO by September 23rd

SIRP needs (not wants) to buy LEO every day using INLEO Inflows (premium, beneficiaries, etc.)

Do the math friends

plus all the $LEO that @leostrategy (and everyone else) moves to leodex will incure a small burn fee - further reducing the supply.

my goal is at least 1% of both LEo & LSTR, I’m almost there with Leo, and about halfway there with LSTR

That's bold.

We are on the right track here.

Question, what if LSTR owns 10 million and POL owns 2 million and 5 million is reduced from supply already and remaining are held by users in their wallet . How will LSTR get more LEO?

⚡️Just looking at this technology stack offered to the world by @dashpay $DASH would be enough to understand how underrated it is

🫡The only true digital cash that simply works

https://inleo.io/threads/view/dashpay/re-leothreads-nidtm8hp

Delegation to 125k $LEO

BOOM

https://inleo.io/threads/view/dagger212/re-leothreads-9q75aqst

What is the benefit of adding liquidity to the LEO:HIVE pool? What token do I earn? How often is payout?

You earn Hive and LEO fees paid directly to your LP.

Do they come from fees on transactions?

Every trade in the pool has a fee. Hive to LEO pays Leo. Leo to Hive pays Hive.

LP means? Staked?

Liquidity Position. You deposit Hive and Leo into the pool then you own a Liquidity Position(LP) of your percentage of the pool. Any fees earned from trading activity are just added to your LP. You can withdraw at any time.

Just be careful because if you want to hold say 1000 LEO long term the pool may not be the best place. If LEO price rises faster than HIVE you will own less LEO and more HIVE.

Too complex for me, I will put this in chatgpt and get back to you lol.

!summarize

Part 1/15:

The Chaotic Summer of Trade Wars: A Deep Dive into America's Economic Fallout

Introduction: Freedom Day Turns into a Summer of Disruption

Bevrijdingsdag, which was meant to symbolize America's economic independence, instead marked the beginning of a tumultuous summer characterized by skyrocketing prices and bureaucratic chaos. What was supposed to be a celebration turned into a period where American manufacturers drowned in the red tape created by their own government, and global supply chains began reconfiguring to avoid American ports. As shoes became 40% more expensive, the summer's turbulence laid bare the shortcomings of aggressive trade policies and their far-reaching consequences.

The Origins of the Trade War: Trump’s Tariffs and the Rationale Behind Them

Part 2/15:

The saga ignited on April 2nd, when President Trump announced sweeping tariffs aimed at revitalizing US manufacturing through protectionist measures. The idea was straightforward: by making imported goods more expensive, domestic producers could regain competitiveness. This bold move marked the most aggressive trade action in nearly a century, with tariffs ranging from 11% up to 50% targeting dozens of countries.

Part 3/15:

The tariffs were not only symbolic but aimed at strategic and geopolitical adversaries like Syria, Myanmar, and Switzerland, with rates nearing 40%. The administration set a 90-day negotiation window, which resembled a hostage situation rather than diplomacy, as countries scrambled to strike deals or face economic isolation. The culmination was the presidential decree of July 31, which formalized the tariffs and triggered immediate market chaos.

The Market Reactions: Shockwaves and Immediate Economic Impact

Part 4/15:

The initial announcement on April 2 doubled as a shockwave across global markets. The US tariffs, averaging 27%, contrasted sharply with the previous 2.5% average in 2024, signifying a seismic shift in American trade policy. During the 90-day period, nations like Vietnam managed to secure exemptions, but many others faced crippling tariffs that distorted global trade.

Financial markets grappled with the fallout: the stock market plummeted, with the S&P 500 dropping 1.6% and the Nasdaq 2.2%, marking one of the worst days in months. Unexpectedly, the US dollar surged despite the trade tensions, illustrating its status as a safe haven. Meanwhile, bond yields fell sharply, and raw material prices surged as traders hurried to assess which supply chains would survive these tariffs.

Part 5/15:

The Reality for American Businesses: Costs and Consequences

The real-world implications hit home immediately. Major automakers like Ford and General Motors saw their input costs skyrocket overnight. Apple projected a quarter impact of $1.1 billion due to tariffs. The National Association of Manufacturers reported that 89% of its members experienced higher costs, largely driven by government-imposed tariffs rather than foreign competition.

Part 6/15:

Small and medium-sized manufacturers bore the brunt, as they couldn't absorb the exponential increase in costs, especially for vital raw materials like steel. Instead of creating jobs domestically, many companies shifted production abroad to dodge tariffs, further weakening America's industrial base. The agricultural sector faced its own crisis, with China replacing US soybeans with Brazilian ones, and Europe rushing to establish new trade agreements with South American nations. Domestic farmers experienced declining exports and rising costs for essentials like fertilizer and machinery, with congressional aid efforts stalling politically.

The Poignant Irony: Offshoring and the Illusion of Patriotism

Part 7/15:

Many Wall Street critics argue that the tariffs are a delayed reckoning for decades of offshoring American jobs. Companies that previously outsourced manufacturing to China now find themselves paying the price as tariffs exacerbate their expenses. The irony is stark: firms that contributed to deindustrialization are now pleading for relief, while the workers—the "frontline" of production—face layoffs and factory closures.

The tariffs, rather than reinvigorate domestic industry, accelerate its decline by making remaining factories less competitive. What was marketed as a patriotic effort to fortify America's industry turns out to be a painful, chemotherapy-like process that hastens the eventual collapse of what little manufacturing remains.

Part 8/15:

The Fiscal Gains for the US Treasury and the Myth of Protectiveness

While industries suffer, the US government reaps record tariff revenues—over $87 billion in the first half of 2025 alone, surpassing total collections for all of 2024. President Trump lauded these figures as proof that tariffs made America "great and rich," but most of these gains come from American consumers bearing the tax burden, not from increased trade fairness.

Analysis reveals that only a tiny fraction (0.7%) of the tariffs’ costs are passed from Chinese exporters to US importers, with the lion's share—more than 99%—being paid by American consumers and businesses. The added costs of shoes, clothing, and electronics are now embedded in household budgets, adding an extra $2,400 annually for the average family.

Part 9/15:

The Inflation or Recession Dilemma: Economic Indicators and Future Risks

Despite the consumer price index remaining within the Federal Reserve's comfort zone at 2.7%, underlying indicators hint at trouble ahead. Import and producer prices are rising, and companies warn of upcoming inflation. Meanwhile, the housing market becomes increasingly unaffordable as tariffs increase costs for materials like Canadian lumber, further pushing up home prices and straining first-time buyers.

Part 10/15:

Consumer behavior is shifting—more people shop at dollar stores, and large retailers report demand for cheaper alternatives. The anticipated "K-shaped" recovery, where the wealthy thrive while the rest falter, appears inevitable. The Federal Reserve finds itself in a trap: raising interest rates to curb inflation risks pushing the economy into recession, while maintaining rates to support growth fuels inflation caused largely by the tariffs themselves.

Tech, Supply Chains, and the Global Shift

Technology companies like Apple and Microsoft warn of margin compression due to tariffs on components, impacting innovation and consumer electronics. Universities and research labs are also reconsidering international partnerships, wary of the geopolitical climate.

Part 11/15:

In response, China is deploying strategic resilience—doubling down on its "dual circulation" policy, boosting domestic consumption, and cultivating alternative markets in Southeast Asia and Africa. Meanwhile, tech firms are relocating production from China to Vietnam, Mexico, and Malaysia to dodge tariffs, maintaining access to the lucrative US market while undermining Washington's efforts at economic decoupling.

Geopolitical Ramifications: India and the Shifting Global Balance

Part 12/15:

India, once a partner of the US-led global supply chain, is now caught in a geopolitical bind. Trump’s tariffs and rhetoric labeled India a "dead economy," denying it exemptions on critical pharmaceuticals and electronics, effectively isolating its economy. This move is part of a broader strategy: China’s influence grows as the US pushes allies away, leading India to diversify its economic partnerships, including strengthening ties with Russia and pivoting towards regional blocks like ASEAN.

This fragmentation risks creating a semi-split world, with regional trade blocs forming in response to US policies—an evolution that could have lasting implications on global stability and economic integration.

The Legal Battles: Executive Powers and Constitutional Challenges

Part 13/15:

Trump’s tariff regime is built upon the International Emergency Economic Powers Act (IEEPA), which claims broad presidential authority during national emergencies. However, legal challenges have arisen, pointing out that the law does not explicitly authorize tariffs and that presidents have historically stretched its limits. A case pending before the Supreme Court questions whether presidents can unilaterally rewrite trade policies under the guise of emergency powers, highlighting the constitutional tension at play.

The Road Ahead: Risks, Profits, and a Divided Economy

Part 14/15:

As the tariffs begin to show their full effect in August, economic indicators point toward shrinking manufacturing activity, declining consumer confidence, and hesitancy among CEOs to invest. The political landscape is also shifting, with Republicans cautious to distance themselves from tariffs ahead of the 2026 midterms, and Democrats struggling to oppose a policy they see as both populist and harmful.

Meanwhile, logistical chaos unfolds at major ports like Los Angeles, where surges in imports strain infrastructure. The government plans to increase tariffs further—potentially raising base rates from 10% to 20% and imposing secondary tariffs of 40% on countries aiding others to evade tariffs—deepening the economic rift.

Conclusion: A Fragile, Dividing Global Economy

Part 15/15:

The summer of trade wars has laid bare the cracks in America's economic fortress. While the treasury reaps record revenues, the real economy suffers—factories close, farmers lose markets, and households bear soaring costs. The global order shifts as countries seek alternatives to US-controlled payment systems and trade networks splinter into regional blocs.

The question remains: will further tariffs "solve" the underlying issues, or will they accelerate the decline of American industrial dominance? History suggests that protective barriers often hasten deindustrialization rather than reverse it, and this summer's chaos might be just the beginning of a long-term recalibration of global economic power.

https://inleo.io/threads/view/thelastdash/re-leothreads-kcfe4tpc

view from the office

No hurricane or tropical cyclone has ever passed over the equator.

Thanks for adding real value to the community. (Ref: LeoThread 2025-08-11 17:03)

#lolz #meme #leo #cent #lstr #pepe #ai #crypto #hive #bbh #duo #dook #pob #grindsquad

The path to financial freedom $LEO 🚀

#freegifs4leo

#grindsquad #duo #dook #aideep

That would be the path to happiness.

We already have taken the first step.

LEO is the key …. $leo

https://inleo.io/threads/view/ishareontwitter/re-leothreads-sjud7pbp

📌 Today in the world @dashpay 🧵

➡️ Recap of the day on our Telegram group 📩

🚨 The hype around $DASH doesn't diminish even during the week of August 15th ✨

🤝 Join us for a free discussion 🗣

👉 https://t.me/dash_chat_italia/83563

1/🧵 how do you want to be remembered for? What legacy do you want to live for your generation to come? Is it something the will be proud of or disappointed?

#outreach #threadstorm

2/🧵The world is not our home; one day we will leave this earth. We will be remembered by the good legacy. Most times I ask myself, 'What will I be remembered for? If tomorrow I am not breathing again, what is that thing people will talk about? Will it be good or bad?' There are some opportunities I am enjoying today; this is as a result of the good legacy my father left behind. When I am no more, I want to be remembered for the good things I do for the people around me. I want to be remembered as a heroine of my community, someone that my community will always sing of my praise even when I am no more. My generation to come will benefit because of the good legacy I left behind.

3/🧵how do you want to be remembered for? What legacy do you want to live for your generation to come? Is it something the will be proud of or disappointed? I will be delighted to read your thoughts on this post below is link to my post.

#gosh

https://inleo.io/@cindynancy/legacy-to-be-remembered--cll?referral=cindynancy

Thank you for your witness vote!

Have a !BEER on me!

To Opt-Out of my witness beer program just comment STOP below

View or trade

BEER.Hey @cindynancy, here is a little bit of

BEERfrom @isnochys for you. Enjoy it!Did you know that <a href='https://dcity.io/cityyou can use BEER at dCity game to buy cards to rule the world.

$7M :)

It is impressive how in so few hours the market capitalization doubled and it is a number that will surely go up, don't you think?

soon 30M$

Hehe. If you didn't said I would thought it as 7k. because at the first look I thought second coma as dot🤣. Sometimes eye also play joke with me🤣🤣.

Wow, I hadn't seen that before, it's impressive and it excites us.

💵 Although many expected a shift to a cashless society, cash continues to be significant for Europeans, even among the youth. According to an ECB report, cash is still important for wealth preservation, particularly after the COVID era.

🇪🇺 The ECB clarifies that the digital euro is intended to complement cash rather than replace it. How do you see the future of cash?

Silent link is a private eSIM provider that accepts Dash for payments! Private digital cash for private mobile data 😎

#dash #crypto

.357

That is the amount of $LSTR I'm missing to reach 10 $LSTR

A veces, un evento ceremonial antes de un partido, puede inspirar a todo un equipo que se encuentra luchando por la azotea..!

1/5 🧵

#outreach #threadstorm #sports #mlb #fulldeportes

Y tal milagro ocurrió ayer en el T-Mobile Park de Seattle, WA, donde los locales Marineros homenajearon al recién exaltado HOF de la MLB Ichiro Suzuki..!

2/5 🧵

También en Milwaukee, un inspirado William Contreras sacó 2 pelotas a la calle y ayudó a los Cerveceros!

3/5 🧵

Mientras, en San Diego, Luis Arráez fue el JMV del juego ganado los Padres, sobre los Medias Rojas, llevándose la serie y acercando a Padres 2 juegos de los Dodgers..!

4/5 🧵

Esto y mucho más en nuestra crónica beisbolera de hoy en #InLeo, escrita para @FullDeportes, dentro del feed de la Blockchain de #Hive:

5/5 🧵 👇

https://inleo.io/@fermionico/milwaukee-san-diego-y-seattle-inspiracin-espeng-opinion-9tp

Greetings , Greetings... I can't believe I'm back here and back for good inother to unleash all I've got in stock. My phone has been faulty all this while that I've been absent from the platform. Happy to be back again. 😀 😍 ✌️

You got some Leo in stock? That's the most important thing right now.

Welcome back buddy.

thanks !

Nice to have you back!

$LEO overtaking #HIVE is a sight to watch. Add to it the #lstr twist and things are only getting more spicy

#outreach #threadstorm

1/ 🧵

A little nostalgia and a lot of promise for the future is what this situation brings to the fore

2/🧵

https://inleo.io/@thetimetravelerz/congratulations-leo-on-overtaking-hive--af1

#gosh

3/🧵

I have a lot to learn if I don’t want to be left behind

Hey amma, nice to LEO you!

Don't hesitate in asking, if you have any question about INLEO (this social network), LeoDex (our decentralized exchange), or any other component of the LEO ecosystem 😊.

Thank you so much

I won’t.

Just hit the ground running and learn on the fly!

Thank you

Welcome!! Don't be afraid to ask questions. Most people here are pretty helpful..

Okay, thanks a lot

This year commemorates 80 years since the dawn of the nuclear era and its lethal capabilities.

#feeling #feeling #mood #ready #pob ##freecompliments

Hi Sammie, nice to LEO you!!

Yeah, I guess you've seen that happiness is the overwhelming mood here on INLEO 😄.

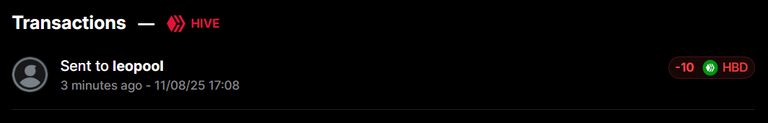

Paid for the premium subscription. I hope the tick mark (✅) beside my profile will come soon.

#premium #subscription #cent

I see it already ;)

Very fast. Maybe within a minute. Thank you for the fast service. I liked it very much.

I see it there already

It disappeared and it reappeared within a single minute. I am impressed.

It didn't go away before.

It went away and after paying it reappeared instantly before I made a thread.

!stats

📊 Leo Strategy Voter Bot Statistics

💪 Total LEO Power: 2.476M LEO

💰 24h Payouts:

• LEO: 11.806 LEO

• LSTR: 1.911 LSTR

• Delegators: 39

!me

👤 Your Leo Strategy Voter Stats

🤝 Your LEO Delegation: 132.000 LEO

💎 Lifetime Earnings:

• LEO: 0.002 LEO

• LSTR: 0.000 LSTR

Stake Based Curation

Drop your best gems, we'll assess depending on post quality.

For more info check below ⬇️

#leocuration

Stake based curation parameters

https://inleo.io/@brando28/eth-vs-btc-monday-market-thoughs-dxq?referral=brando28

https://inleo.io/@godfish/radical-tenderness-3ot

This is my post of the day

https://inleo.io/@cumanauta/about-mass-velocity-debt-and-inflation-kg4?referral=cumanauta

https://inleo.io/@intishar/impression-of-a-stranger-6zb

https://inleo.io/@vimukthi/my-research-on-the-beginning-of-altseason-and-what-i-invested-in-fzs

https://inleo.io/@lbi-token/guess-the-rune-price-and-win-7w6

https://inleo.io/@mcoinz79/myleogoals-feed-the-sirp-blr

https://inleo.io/@wiseagent/the-beer-monopoly-in-brazil-l2h

https://inleo.io/signup?referral=sammie42

The response of premium subscription is quite fast. Maybe within a single minute. It's impressive. I liked the speed.

#premium #subscription #speed #cent

That's true because I didn't notice the difference

Hmm.

Oh, so it has been improved lately 🙃.

Good to know, thanks Intishar!

That's good for us.

Open sell orders up to 1.5 hive

(plus some work in the pool) but we will get there!)

Thanks for these screenshots, Rainbow!

Which app do they come from?

https://hive.ausbit.dev/token/leo

Cheers! Works for all hive engine tokens, just change the url with the token on the end.

On mobile I need to refresh ot a few times to have it load correctly sometimes. But gives great insights!

Enjoy

I believe that we can cross that within week. What do you think?

hmm depends there is still some buying power to do so, but moving the pool and get the arbitrage bots to build support there is getting more expensive.

So it depends on the pace the team decides to set, if the h-e richlist shows big unstaking coming up waiting here might be smart to save some capital. That being said, I see nothing but momentum for the next few weeks so yeah We will get to $1

Any idea what your 100% LEO Vote would be worth when #LEO hits $1, $10 and $50?

Thank you #lstr

It's different for everyone I think. The LP amount will be the factor for that.

Give me that vote and we'll see again in 10 years : P

It was a great day, just eat my dinner, though so early. I feel energized for engagement.

It was a good day for me but it was a busy day. I am exhausted but I have to write my research paper till late night.

Those who grew up immersed in video games and mastering the meta are now translating those skills into the business world.

The coming decade is going to be exciting.

No sign of weakness. Don't complain, Don't explain. Just believe. Believe.

#motivation ##askonleo #pob #vibes

#leo is taking #hive to school. When will the Whales learn?

https://inleo.io/threads/view/khaleelkazi/re-leothreads-uarurakh

https://inleo.io/threads/view/khaleelkazi/re-leothreads-agwfxe2j

Is $LEO ready to SURGE?

On your move we count. Bring it on 🚀🚀

Indeed!!

What you got?

@leostrategy how much swap.hive is left from initial sale of lstr?

yes it is

yes … I can feel it in my bones

⚡ Actifit isn’t an app.

It’s a crypto-powered movement revolution. 💪

Join thousands earning while getting fit.

📲 Download. Move. Earn. Repeat.

But, can someone use it to earn without doing daily report on posts?

I'm not sure but that were most of your rewards come from...

No you need to post the daily report

I herald Galactus to steal Your Leo!

#memes

Enter in the daily.meme contest ;)

SURGE?

surging all the time the urge to buy more leo

Today's news events

!vote

✅ Voted thread successfully!

Vote weight: 5.25%

A genuine woman values the quality of attention over its quantity. Thus, the gaze from the one right man is the only one that truly matters to her. His gaze is the only one that fully validates and affirms her.

All other attention is just unwanted desire.

https://inleo.io/threads/view/khaleelkazi/re-leothreads-agwfxe2j

📈 MARKET ORDER CLOSED 📈

💰@leopool bought 96 $LEO for 99 $SWAP.HIVE at avg price 1.036471 SWAP.HIVE/LEO on #hiveengine

💲 USD Value: $22.5

✅🔗https://he.dtools.dev/tx/273a361695f6cdb498010b9694522beebfa7de9c

📣 Live Tuesday, August 12th at 5:00 PM

🎙 Web3 Global Talk (👇1): "📻 GM - Join us at Web3 Global Talks on Tuesday!"

Powered by @dashpay $DASH

Set your reminders (👇2)

$LSTR is one of the most important components to the Leo ecosystem. It is the value capture token for the financial activities on here.

The ROI on LSTR versus LEO should be significantly higher. This is what will capture people's attention.

For example, 50 cent LEO probably puts LSTR at $15.

It's a leverage investement into leo

Big time. And going to be leveraged more with additional revenue streams. That is the key point that I think people need to understand.

It is not leverage simply for the sake of leverage.

Another Ancient Promise Delivered

Do not underestimate the perseverance of #leo team. There was a vision and despite all the troubles coming from all sides, we have 0% #crypto loans ready.

These are safe and sustainable loans. Protocol will generate revenue instead of keeping the assets idle. There is no need to charge interest to users.

LEO is becoming more like Sky (Maker DAO). Adjust valuations accordingly.

https://inleo.io/threads/view/khaleelkazi/re-leothreads-35ga2ebgn

#threadstorm #outreach

1/ 🧵

The LEO token has impressed us with its performance this month. However, it didn't happen by chance; there's a backstory we need to consider, one that involves a great deal of work and staged ideas that made this remarkable price surge possible.

#crypto #finance #growth

2/🧵

An economy is strengthening that involves ideas perfectly designed for sustainable, yet exponential, growth. More users are seeing this opportunity, as are investors who see a product being given consistency and dedication; something that LEO demonstrates daily.

3/🧵

It's truly incredible the new developments that arrive every day, the proposals to improve what is already amazing, and most of all, seeing how what's being created works under a well-thought-out logic.

I invite you to read my new article, which briefly reviews the impact LEO is having.

https://inleo.io/@vikvitnik/leos-growth-is-truly-impressive-when-ideas-operate-under-a-tangible-logic-any-goal-can-be-achieved-38y

!summarize

Part 1/11:

Commemorating Two Years of The Great War: A Detailed Weekly Breakdown

As the weeks pass, each episode of The Great War kicks off with a captivating hook—whether it's the first use of poison gas, Italy joining the battlefield, or another intense event. This week’s opening is particularly striking: "This war has now been raging for exactly two years." Host Indy Neidell sets the tone for a comprehensive review of the ongoing conflict, highlighting major battles and strategic developments from the past week.

The Battle of the Somme Continues Amid Chaos

Part 2/11:

Last week saw Australian forces launch a diversionary attack at Fréméry, aiming to halt the German advance towards the Somme. However, the operation turned into a disaster because many German units had no intention of heading south. The British managed a night assault at the Somme but lacked subsequent support to capitalize on their gains.

On the Eastern Front, Russian forces made steady progress, continuing their assault against Austria-Hungary’s lines. The situation remained dire for the Central Powers in that region.

Disorganized Attacks and Poor Coordination

Part 3/11:

The planned French and British assault on July 23 turned into a chaotic series of uncoordinated attacks. The French commander Maurice Balfourier announced he wouldn't be ready until July 24, prompting British General Sir Henry Rawlinson to proceed without full French support. Starting with a preliminary artillery bombardment on July 22 at 7 pm and the main attack at 1:30 am on July 23, the offensive soon faced logistical issues.

Further complicating matters, French forces under Cambrai’s 13th Army and Fayolle’s units planned their attack at 3:40 am without clear explanations. These fragmented timing decisions—which included a surprise second assault mimicking the main attack hours earlier—led to overlapping attacks, exposing the element of surprise and causing chaos among the Allied forces.

Part 4/11:

Weather and Tactics Negate Initial Plans

Poor weather conditions for days prior prevented effective artillery observation, crucial since many German trenches were positioned on reverse slopes and difficult to target directly. Consequently, the early assaults became major but futile attempts that resulted in frustration and staggering losses. It was a stark example of how logistical misjudgments and lack of coordination could turn promising assaults into disastrous failures.

Success on the British Right Flank

Part 5/11:

Amidst the chaos, the British artillery near Gieaumont was effective, devastating German trench defenses with well-aimed bombardments. Unfortunately, German soldiers adapted quickly, employing new tactics: they moved machine guns outside trenches into rifle pits, making them harder to locate and destroy.

British artillery responded with larger-than-ever bombardments, using massive quantities of shells—over 36,800 cannons firing approximately 125,000,000 pounds of explosives—to soften enemy positions. When the infantry advanced, they made significant progress, capturing Longueval and Delville Forest, and pushing further into enemy territory despite high casualties from machine gun fire from the flanks.

The Eastern Front: Russian Advances and Austrian Retreats

Part 6/11:

On the Eastern Front, Russian forces under Aleksandr Brusilov launched a massive offensive that saw considerable success. By July 28, they had taken Brody, capturing 40,000 prisoners over 12 days. The entire Austrian Second Army retreated, exposing significant weaknesses in the Austro-Hungarian military structure.

Leadership Challenges and German Involvement

This collapse prompted sharp criticism of Austrian command, especially Chief of Staff Conrad von Hötzendorf, who was facing the threat of losing his position. The high command concluded that the primary problem lay in leadership, not troop strength. Recommendations included integrating German and Austro-Hungarian forces for better coordination.

Part 7/11:

German Field Marshal Paul von Hindenburg and General Erich Ludendorff took charge of a large part of the Eastern Front, especially along Pripet. They aimed to seize full control of the eastern theater, but this involved political complexities, including reduced influence for Austrian commanders like Karl von Franza-Baldin who now had German advisors.

Strategic Struggles and Political Intrigue

German military leadership, notably Erich von Falkenhayn, sought to dominate the eastern front. However, their control was challenged by the ongoing stalemate at Verdun, the shifting fortunes at the Somme, and the potential entry of Romania into the Allies. These developments diminished Germany's strategic confidence and placed pressure on leadership decisions.

Part 8/11:

Meanwhile, the fragile coordination within the Austro-Hungarian army caused issues, with some commanders advocating for a merger with German forces, as the Germans consistently performed better on the battlefield.

The Battle of the Baranovichi: A Month-Long Clash Ends

After a prolonged month of fighting, the Battle of Baranovichi concluded, finally bringing relief to Russian forces. Despite their numerical disadvantage—Russia’s army was approximately 40% the size of the German forces—Russian troops inflicted relatively minor casualties on the Germans (around 16,000 compared to Russian losses of 80,000).

Part 9/11:

While the defeat was a blow to Russian morale, they achieved significant success in Asia Minor, capturing Erzincan from Ottoman forces. This duality highlighted the ongoing ebb and flow of the war, with victories and setbacks occurring simultaneously across different fronts.

Other Significant Events

Arab Revolt Gains Momentum: On July 27, the port of Jaffa in Palestine was captured by Arab insurgents, marking a key strategic victory in the Arab revolt against Ottoman rule.

The Trial and Execution of Charles Fayet: The captain of the Belgian ship Brussels, Charles Fayet, faced military court for attempting to ram a German U-boat. Found guilty of piracy, he was executed by German forces—a tragic testament to wartime justice.

Part 10/11:

Reflection: Two Years of Global Conflict