THORFi Cross-Chain Lending: Collateralized, Zero Interest, No Liquidation, No Expiry Loans

Collateralized cryptocurrency lending has been around for a while in both centralized and decentralized platforms, providing users with the opportunities to borrow digital assets by providing collateral.

Most recently, THORChain launched its own revolutionary crypto lending protocol (currently in Beta phase) on THORSwap where users can borrow any of the supported cross-chain assets via dollar-pegged loans by providing native digital assets like Bitcoin (BTC) and Ether (ETH).

As many would already know, THORSwap is the leading "multi-chain decentralized exchange (DEX) aggregator which is powered by THORChain, where users can perform cross-chain swaps in a permissionless, trustless, and non-custodial manner."¹

Let's take a closer look below.

THORFi Lending

This is the newest protocol on THORChain that ensures decentralization by allowing users to borrow and lend native assets (as collateral) without any intermediaries.

THORChain Lending enables users to deposit native collateral, and then create a debt at a Collateralization Ratio (CR). The debt is always denominated in USD (TOR), regardless of what Layer 1 asset the user receives. All loans have 0% interest, no liquidations, and no expiration. Risk is contained by limits on collateral for each pool, slip-based fees when opening and closing loans, dynamic CR, and a circuit breaker on RUNE supply.²

In layman's terms, loans via THORChain Lending are basically stress-free since they incur no interest, no risk of liquidation, and no expiry dates. Users can use Layer 1 crypto assets (BTC and ETH) as collateral and then borrow any of the supported assets including cross-chain ERC tokens, but the value of the loan will always be accounted (calculated) in USD value based on TOR.

There are certain controls employed so as to limit lending risks, including putting a limit cap on collaterals and more have been laid out in the documentation.

Supported Collateral

At the time of this writing, collaterals accepted on THORChain Lending are BTC and ETH. Accordingly, more options including BNB, BCH, LTC, ATOM, AVAX, and DOGE will be added in the near future.

Users can borrow any assets supported by THORSwap — including various ERC-20 tokens on Ethereum and Avalanche via DEX Aggregation. Just like a cross-chain swap, borrowers will receive the asset they want in their wallets on the correct chain in a single seamless transaction.³

In short, native BTC and ETH are accepted as collaterals to borrow any asset in any network as long as THORChain supports them.

Unique Lending Features/Terms

The lending boosts some really ground-breaking terms as a result of how strategically it has been designed, thereby making it unique from other crypto lending protocols.

Zero (0%) Interest

Except for slippage fees on opening and closing loans, borrowers will no longer need to pay any hefty interest rates on their loans.

No Liquidations

Being liquidated for not being able to pay a loan is common in crypto borrowing. THORChain's Lending changes this so the borrower's collateral is at least safe and secure.

No Expiry

Loans do not have any set repayment dates. Borrowers can keep their loans for as long as they want.

By not pressuring borrowers to repay quickly, the system attracts more outside capital, increasing the value and stability of the network, making lending more attractive and beneficial for both borrowers and THORChain. Therefore, there’s no need for interest, liquidations or expiration.⁴

Minimum Loan Term

The shortest borrowing time is 30 days. Meaning, repayment is allowed only after such a period.

The loans are denominated in TOR (a USD equivalent)

While loans are in terms of TOR (USD-pegged), they can be repaid in any THORChain-supported assets including stablecoins.

Source

How a Loan is Calculated

The amount of loan a borrower receives is "calculated based on the Collateralization Ratio (CR) in proportion to the collateral. And depending on market conditions, CR can range from 200% to 500%."⁵

Example:

If CR is 200%, a user needs to supply $200 worth of BTC or ETH as collateral to borrow $100 USDC.

If CR = 500%, a borrower will have to provide $500 worth of BTC or ETH in order to get loaned $100 USDC.

The higher the Collateral Ratio, the collateral value a user needs to provide for a loan should be higher too.

How THORChain Lending Works

➡️Opening a loan

When a loan is opened, the collateral is swapped to RUNE (the native token of THORChain) and the difference between the loan value and collateral is burned.

For example:

I open a loan in USDC at the following situation:

- ✳️Collateral Ratio = 200%

- ✳️Loan-To-Value Ratio = 50%

- ✳️1 BTC as collateral = value at the time is $20k

- ✳️RUNE price at loan opening = $2

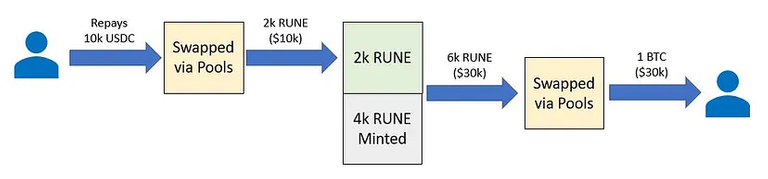

Once I put up (deposit) my collateral (1 BTC), the protocol swaps it to RUNE ($20k/$2 = 10k RUNE). At 50% LTV, it means I can only borrow half the value of my collateral. So that will be $10k USDC (5k RUNE). The lending protocol burns half of the RUNE, swaps the remaining 5k to USDC, and then sends it to my wallet (minus the slippage fee). Below is the diagram of the process.

Note: These processes are done by the protocol so you won't need to do anything other than initiate the borrowing and approving the transaction on your wallet.

➡️What happens when I repay the loan?**

Remember, there is no interest so I will be paying the exact same amount it was given to me ($10k).

Let's say at the time of my repayment, the following applies:

- ✳️1 BTC value has increased to $30k;

- ✳️1 RUNE is $5

Upon receiving my payment (10k USDC), the protocol swaps my repayment amount ($10k USDC) to RUNE (which results to 2k RUNE) but that would only be $10k and the protocol needs to give me back my 1 BTC (minus slippage fee). To do that, it mints RUNE for the balance ($20k USDC = 6k RUNE). After which, it swaps all the RUNE to 1 BTC and returns it to my wallet, the slippage fee deducted.

Here's the diagram of the process.

While it looks like there's too many steps involved, the loan is actually done in a seamless transaction. The protocol does all the swapping and you won't see them. You will just receive your loaned amount (minus the slippage fee).

Opening a Loan

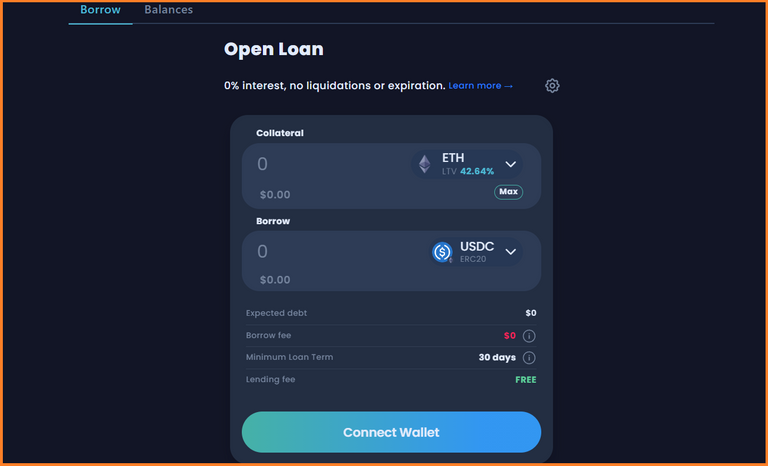

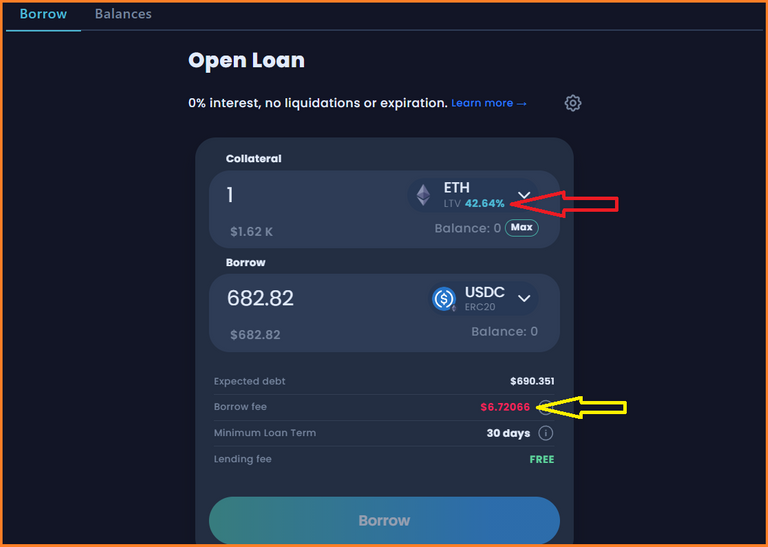

Visit the site and connect your wallet.

On the loan window, you can see the Loan-to-Value (LTV) Ratio of your collateral. The maximum loan amount is automatically calculated, including the slippage fee (Borrow Fee) which fluctuates so one can wait up to get a more favorable fee.

You can open another loan even if you have an existing one. But that means you will have to put up or deposit another fresh collateral.

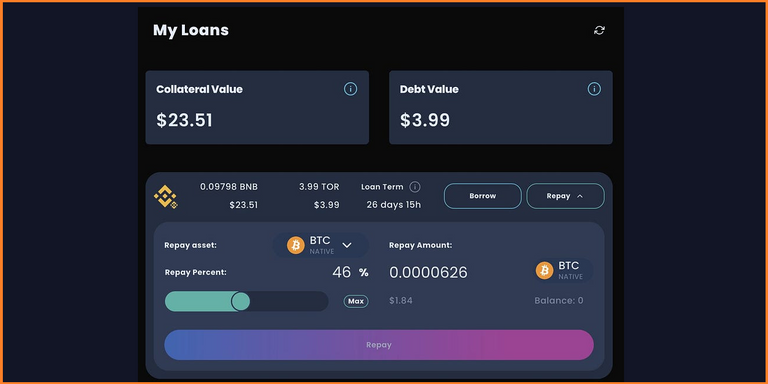

Repaying a Loan

Go to the app and click on "My Loans" tab. All the details of your existing loan are there.

You can choose to pay the loan in any of the supported assets (not necessarily the asset you received when you opened it). You can also repay in full or just a certain percentage of it. And you can open another loan as long as you deposit another collateral.

Summary (TL;DR)

THORChain Lending went live yesterday with unique features which are basically stress-free for borrowers - no interest fee, no expiry date, no liquidation. Such is possible as the lending is strategically designed to be such through various mechanisms like dynamic CR, Slip-based fee on opening and closing loans, capped collateral for each pool, circuit breaker on RUNE supply, and others.

With Collateral Ratio, the value of collateral deposited is always higher than the loan value. Even when the price of the collateral drops, there is no risk as they have already been swapped to RUNE at the time the loan was opened.

Currently, collaterals accepted are Bitcoin and Ether. Expected assets to be added soon are BNB, ATOM, LTC, BCH, AVAX, and DOGE.

Users can borrow any of the supported assets and can repay them in any other assets too (not necessarily the same asset which they received when they opened the loan). The loan value is however always calculated in terms of USD (TOR).

Users can repay the loan in partial or in full after the minimum loan period (currently set as 30 days). They can borrow even when they have existing loans but they have to deposit fresh collateral.

[For information only. DYOR. Info Sources: THORSwap Docs / Crypto University / THORChain / Medium / THORSwap]

Lead image created on Canva. Logo from THORSwap. Screenshots linked directly to their sources. No copyright infringement intended. 23082023/10:25ph

Posted Using LeoFinance Alpha

This is fascinating. I had not paid attention to THOR since it first came out. I think this could simplify things for me. Although, I'll have to spend time learning how to get around. Thanks for posting. It is perfectly timed for me.

Another interesting service or feature of THORChain. Thank you too and all the best to you as you explore more of it.

!PIZZA

Thanks for sharing this content with us, it really a great privilege for me reading this post which I can see a lot of benefits from it. I think hive has been a platform to learn and improve our knowledge everyday.

Thank you and you are right, we learn every day and sharing is one of the ways I learn myself 🙂

Yes! I guess you’re right, if we are able to share what we know with people here is going to help a lot of less privileged people about what’s happening around them.

That could be too. In addition, I am not well-versed in crypto things and researching on topics to write about is another form of learning for me :)

!CTP

$PIZZA slices delivered:

ifarmgirl tipped intishar

@ifarmgirl(2/5) tipped @djbravo

ifarmgirl tipped shainemata

ifarmgirl tipped b-hive

Di ko pa alam yan though alam kong sikat ang ang Thorchain. Hehe

Bago lang sya. Kaka-launch lang.

!PIZZA

I will have to study the leasing system. Do you like to earn money by lending?

!LOL

!MEME

lolztoken.com

They can't see the red flags.

Credit: reddit

@ifarmgirl, I sent you an $LOLZ on behalf of myintmo.shweyi

(1/4)

ENTER @WIN.HIVE'S DAILY DRAW AND WIN HIVE!

Credit: gymnasticsqueen

Earn Crypto for your Memes @ HiveMe.me!

Go for it and best of luck :)

I do like to earn in various ways 😉

!CTP

It is funny how I never took this seriously even though my friends are but this will be an avenue for me to learn more

Thank you so much for sharing

Thank you too, and pleasure to share !LADY

View or trade

LOHtokens.@ifarmgirl, you successfully shared 0.1000 LOH with @rafzat and you earned 0.1000 LOH as tips. (1/18 calls)

Use !LADY command to share LOH! More details available in this post.

That's interesting and more interesting is there is no expiry date.

It means I need to give them my assets as a backup if I want to take loans. Right?

In that case why they are providing the facility if there is no benefit for them? How they will be benefited from the process? I am curious.

Yes. You need to put up a collateral for you to be able to take a loan. The collateral value is always higher than the loan value. What is interesting is that, no one holds your collateral because once you deposit it, it is swapped to RUNE in the liquidity pools.

So the protocol earns from the swapping fee and slippage too. And the more people opening loans, there's more assets swapped to RUNE which can drive the price up too.

!PIZZA

Understood.

Thank you for sharing your knowledge.

Always a pleasure, Inti. As I often mention, I'm learning too through this 😉

https://twitter.com/lee19389/status/1694347578177880167

#hive #posh

I think we have seen many such projects before but they didn't succeed and even now if we see there are many projects which give a lot of money within the bull market. were and are now giving negligible amount of money and how many are there who have disappeared right before our eyes

Projects come and go, others stay. THORChain, in my opinion has been doing well :)

It is recommended to for one to do his own due diligence before jumping into something.

!PIZZA

Yeah you are right. Thanks for the suggestion.